The New Retirement Plan Save Almost Everything, Spend Virtually Nothing Retirement planning

Developing a Realizable Vision for Retirement Lifetime Paradigm

Here are its key characteristics. 1) A single plan. AWRP's investment options would resemble those of the federal government's Thrift Savings Plan. It would contain 1) a government bond fund,.

Retirement Savings Plans for Expats Smash your Goals!

Getty When it comes to retirement planning, Americans are often way behind. In fact, in 2019, almost half of households headed by someone 55 or older had no retirement savings at all,.

Ms. Hall’s apartment is 400 square feet. Work Family, Grocery Budgeting, Retirement Planning

Three to five years before retirement, if time allows, treat this window as a dress rehearsal. For example, if volunteering is important, join one or two organizations in advance to ensure that.

Retirement is the new retirement plan InvestmentNews

Center for Retirement Research at Boston College, based on data from the Survey of Consumer Finances (amount of senior household debt); Employee Benefit Research Institute estimates (percentage.

The New Retirement Plan Save Almost Everything, Spend Virtually Nothing WSJ

The federal spending package unveiled on Tuesday includes new provisions that would alter how millions of Americans save for retirement, including older people who want to stash away extra.

How to Save For Retirement Planning Kids Off The Block

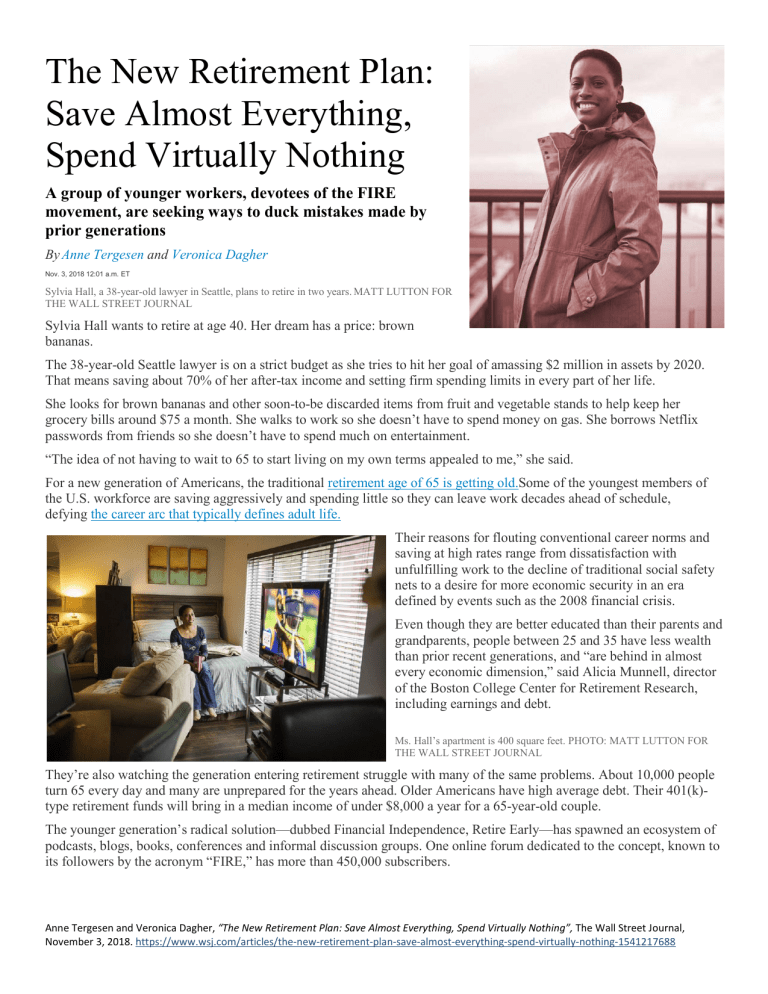

For a new generation of Americans, the traditional retirement age of 65 is getting old. Some of the youngest members of the U.S. workforce are saving aggressively and spending little so they can leave work decades ahead of schedule, defying the career arc that typically defines adult life.

This Is the Best Retirement Strategy for Seniors The Motley Fool

A self made financially independent individual is someone who went against general trends in society for a decent length of time, who now suddenly has essentially infinite free time (e.g. probably 10 times the amount of a salaried worker or more, normalizing for energy levels).

The Everything Retirement Planning Book eBook by Judith B Harrington, Stanley J. Steinberg

Open a health savings account (HSA) If you don't have access to a 401 (k), Bakkum suggests maximizing other company benefits. A health savings account (HSA) lets you put pre-taxed funds aside.

IRS Announces 2022 Limits for Retirement Plans

The New Retirement Plan: Save Almost Everything, Spend Virtually Nothing (#GotBitcoin) Sylvia Hall wants to retire at age 40. Her dream has a price: brown bananas. The 38-year-old Seattle lawyer is on a strict budget as she tries to hit her goal of amassing $2 million in assets by 2020.

Working with a Financial Counselor to Plan Your Retirement

A group of younger workers, devotees the the FIRE movement, are seeking trails to leave the workplace decades ahead of the norm, ducked mistakes made the previous generations. One woman's grocery total is so extensive she knows how much yours will pay all month for oatmeal: five pounds for $3.

I Have A Retirement Plan I Plan On Traveling SVG Cut File Etsy

According to the World Economic Forum, life expectancy rose from an average of 48 to 73 years between 1950 and 2019. This is further pressuring the retirement savings gap and has raised the full.

Retirement calculator How much you need to save Canada News Group

The New Retirement Plan: Save Almost Everything, Spend Virtually Nothing (#GotBitcoin?) Monty Henry Owner of DPL-Surveillance-Equipment.com LLC Published Nov 5, 2018 + Follow A group of younger.

6 Article The New Retirement Plan Save Almost Everything, Spend Virtually Nothing WSJ (1)

The SECURE Act 2.0, enacted in late 2022, changed more than 90 rules about IRAs and other qualified retirement plans. The changes are phased in over several years. Here are some key changes.

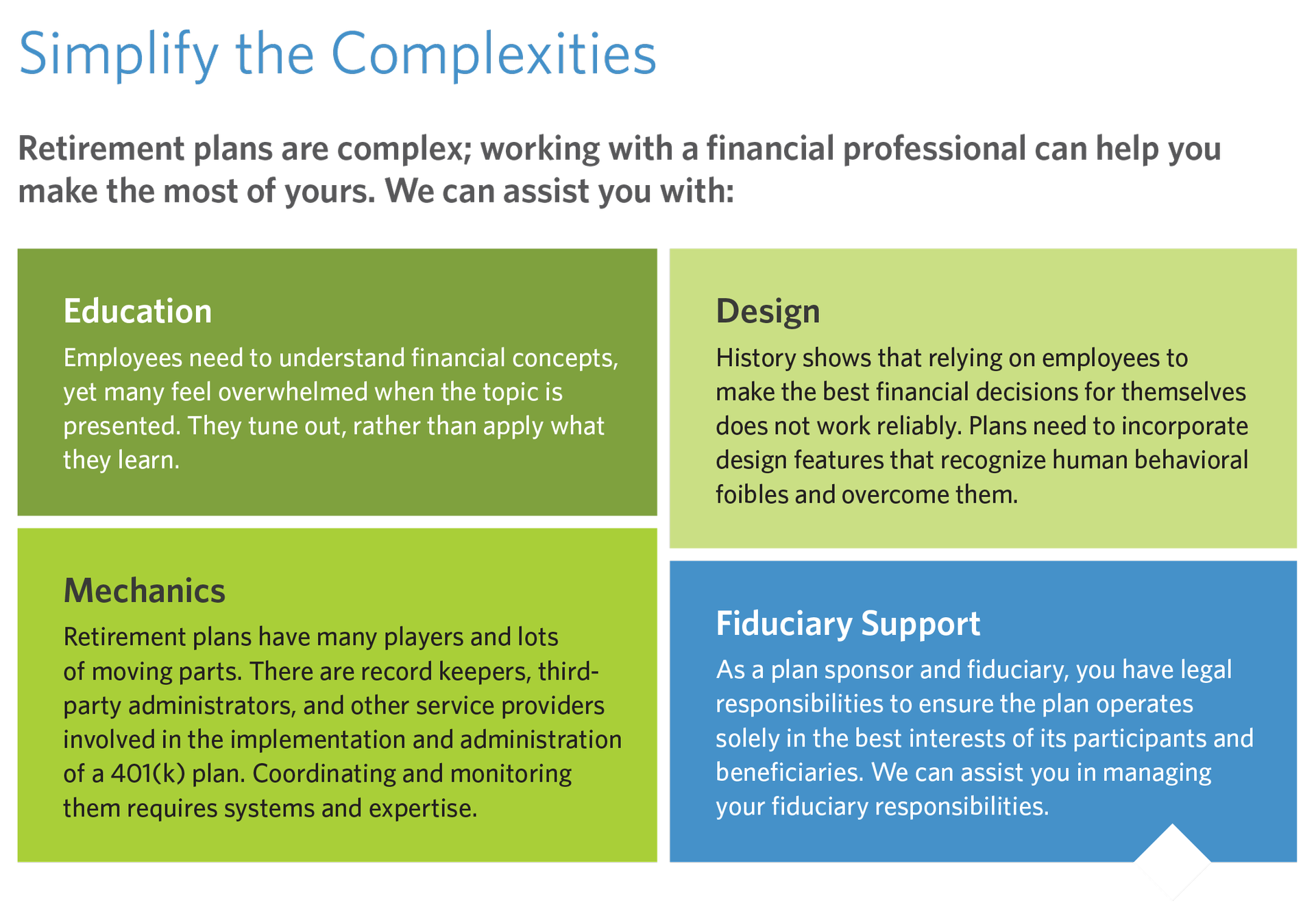

Retirement Plans D. Eggers III, M.Ed., AIF®,CRPC® CPFA®

The New Retirement Plan: Save Almost Everything, Spend Virtually Nothing A group of younger workers, devotees of the FIRE movement, are seeking ways to duck mistakes made by prior generations.

Why Interning At 60 Is The New Retirement Plan Job hunting tips, Job hunting, Retirement planning

The legislation, known as Secure 2.0 (a follow-up to the Secure Act of 2019), has significant new rules for saving for retirement, withdrawing money from retirement plans, dealing with financial.

Rebuild your retirement savings

39.5%. 2024. 2026. It may not be possible to set aside a huge chunk of your earnings, so start small and set up automatic transfers from your paycheck or bank account. Even funneling as little as.